A rent-to-own lease agreement contains a standard lease with the added option of the tenant being able to purchase the property for agreed-upon terms. The tenant will continue to pay rent on a monthly basis while having the option to purchase the property. When the tenant wants to exercise the option, they will be required to send written notice to the landlord.

Table of Contents

- Rent-to-Own Lease: By State

- What is a Rent-to-Own Agreement?

- How to Structure (2 parts)

- Seller Financing

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

What is a Rent-to-Own Agreement?

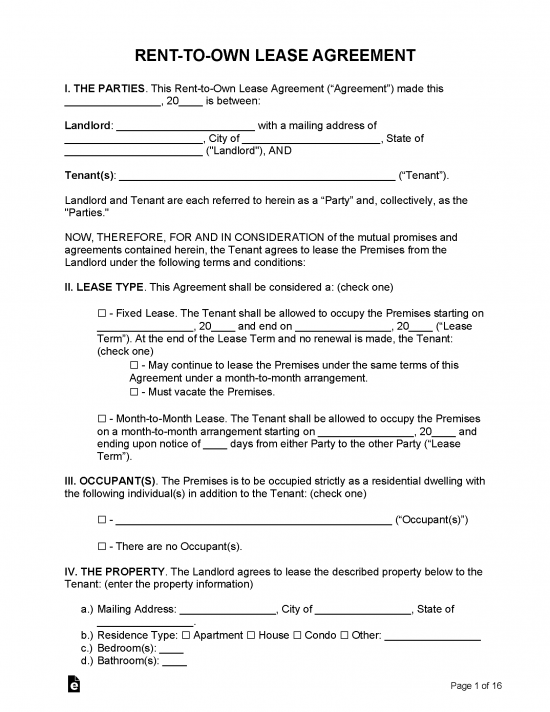

A rent-to-own lease agreement is a rental contract that contains an option for the tenant to buy the property. The option will have simple terms and conditions such as a purchase price and days to a closing. When exercised, the option to purchase will convert to a purchase agreement.

How to Structure (2 parts)

Part 1 – Residential Lease

The first part contains a standard lease where the landlord and tenant should agree to the following:

- Names of the Landlord and Tenant(s):

- Names of all Occupants;

- Start and End Dates;

- Monthly Rent ($);

- Security Deposit;

- Fees;

- Pets;

- Entry Rights;

- Services; and

- Utilities.

Part 2 – Option to Purchase (Addendum)

It is highly recommended to write the addendum with an agreed-upon purchase price. This allows the tenant to obtain financing before executing the option to purchase. An option to purchase should include:

- Consideration;

- Option Term;

- Deposit Amount;

- Purchase Price ($);

- Personal Property;

- Fixtures;

- Inspection Period;

- Title Search;

- Closing Date; and

- Owner Financing (if any).

Seller Financing

Seller financing allows the owner to act as the bank and collect payments and interest. The seller would retain a first (1st) mortgage on the property so if the buyer stopped payment the seller would be protected. In addition, there are tax advantages to each party.

Tax Advantages

There are tax advantages to both the buyer and seller when choosing seller financing.

Seller

The seller will be collecting principal and interest on each mortgage payment. The seller will be paying capital gains (15% to 20%) on the principal amount and personal income tax on the interest collected. This will lessen the seller’s tax burden versus collecting rent which is tax at the personal income tax rate.

Buyer

The buyer will be able to write off the interest paid to the seller. Especially if the loan is amortized, the initial payments are mostly attributable to interest.