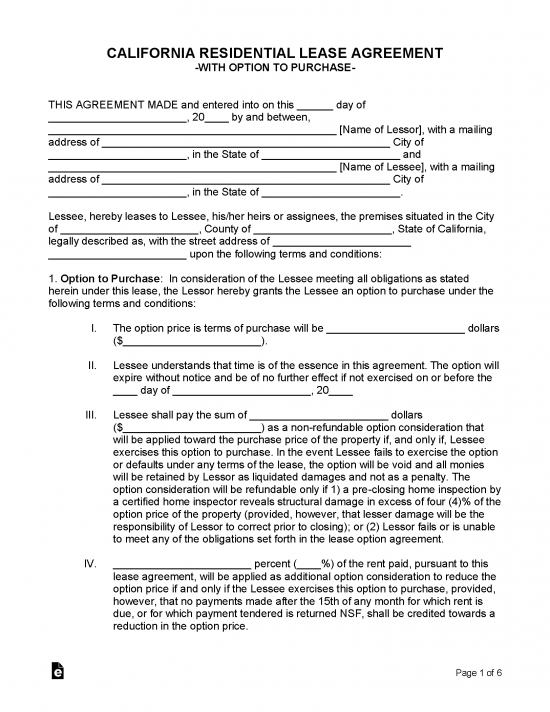

A California lease-to-own lease agreement is a legal contract used by a landlord and their tenant when looking to establish a rental arrangement with an added option to purchase. The renter, at any moment in their tenancy, may exercise the option to buy the property currently being occupied. Typically, in these leases, the rental costs are higher due to the possibility of that money being held in an escrow account until the tenant decides to purchase. The rates and allocation of paid rent may vary depending on the situation, however. Note that the buying option may or may not be exercised based on the tenant’s intentions. The leasing contract should be drafted with terms anticipating each potential outcome, whether the tenant opts to purchase or not.

Seller Disclosures

The following disclosures must be completed by the landlord and given to the purchaser.

If a buyer fails to receive any of the disclosures listed below, they may have three (3) days to terminate the agreement (or five days from the date of mailing) by delivering notice to the seller or seller’s agent (CC § 1102.3).

Environmental Hazards Pamphlet (CC § 2079.7) – A copy of the entire pamphlet must be given to the buyer(s).

Environmental Hazards Pamphlet (CC § 2079.7) – A copy of the entire pamphlet must be given to the buyer(s).

Download: Adobe PDF

Homeowner’s Guide to Earthquake Safety (CC § 2079.8, CC § 2079.9) – A copy must be provided to the buyer.

Homeowner’s Guide to Earthquake Safety (CC § 2079.8, CC § 2079.9) – A copy must be provided to the buyer.

Download: Adobe PDF

Lead-Based Paint Disclosure – Federal law dictates this disclosure must accompany any purchase agreement of a property built prior to 1978.

Lead-Based Paint Disclosure – Federal law dictates this disclosure must accompany any purchase agreement of a property built prior to 1978.

Download: Adobe PDF

Local Option Real Estate Transfer Disclosure Statement (CC § 1102.6a) – Must be completed if required by the local jurisdiction.

Local Option Real Estate Transfer Disclosure Statement (CC § 1102.6a) – Must be completed if required by the local jurisdiction.

Download: Adobe PDF

Natural Hazard Disclosure Statement (CC § 1103.1) – Seller must complete this disclosure if the property is near any natural hazardous areas.

Natural Hazard Disclosure Statement (CC § 1103.1) – Seller must complete this disclosure if the property is near any natural hazardous areas.

Download: Adobe PDF

Real Estate Tax Disclosure (CC § 1102.6c) – The following must be included in a lease agreement in 12-point font with a 14-point font title:

Notice of Your ‘Supplemental’ Property Tax Bill

California property tax law requires the Assessor to revalue real property at the time the ownership of the property changes. Because of this law, you may receive one or two supplemental tax bills, depending on when your loan closes.

The supplemental tax bills are not mailed to your lender. If you have arranged for your property tax payments to be paid through an impound account, the supplemental tax bills will not be paid by your lender. It is your responsibility to pay these supplemental bills directly to the Tax Collector. If you have any question concerning this matter, please call your local Tax Collector’s Office.

Transfer Disclosure Statement (TDS) (CC § 1102) – Specific form required by law to be completed by the seller of a residential property.

Transfer Disclosure Statement (TDS) (CC § 1102) – Specific form required by law to be completed by the seller of a residential property.

Download: Adobe PDF

Water Heater and Smoke Detector Compliance (HSC § 13113.8) – Must be handed to the purchaser(s) to ensure them that the smoke detector and water heater are in compliance with State law.

Water Heater and Smoke Detector Compliance (HSC § 13113.8) – Must be handed to the purchaser(s) to ensure them that the smoke detector and water heater are in compliance with State law.

Download: Adobe PDF

Water-Conserving Fixtures and Detector Notice (CC § 1101.4) – Used to inform the buyer about water-conserving fixtures that need to be replaced on new construction and of the carbon monoxide detectors’ status.

Water-Conserving Fixtures and Detector Notice (CC § 1101.4) – Used to inform the buyer about water-conserving fixtures that need to be replaced on new construction and of the carbon monoxide detectors’ status.

Download: Adobe PDF

Wood Destroying Pests and Organisms Inspection Report (BPC § 8516) – Must be given to the buyer(s) after the inspection is completed.

Wood Destroying Pests and Organisms Inspection Report (BPC § 8516) – Must be given to the buyer(s) after the inspection is completed.

Download: Adobe PDF