New Jersey lease agreements bind landlords and tenants to the terms of a lease of property in exchange for monthly rent. The landlord and the tenant will agree in writing to the property’s rent, which party is responsible for utilities, and other terms that they want to include. Both parties should keep a copy of the lease agreement, and refer to it when questions arise as to their obligations under the lease.

Contents

By Type (6)

- Commercial Lease Agreement

- Month-to-Month Lease Agreement

- Rent-to-Own Lease Agreement

- Roommate Lease Agreement

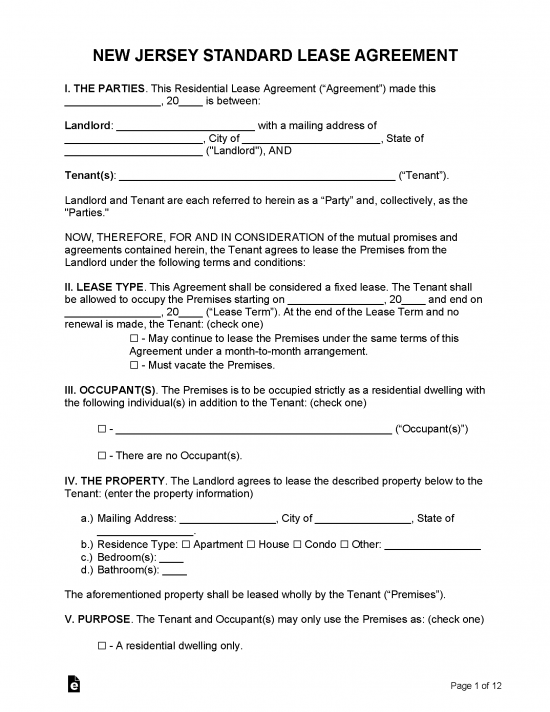

- Standard Lease Agreement

- Sublease Agreement

Download: Adobe PDF, MS Word, Rich Text Format

Month-to-Month Lease Agreement

Month-to-Month Lease Agreement

Download: Adobe PDF, MS Word, Rich Text Format

Download: Adobe PDF, MS Word, Rich Text Format

Download: Adobe PDF, MS Word, Rich Text Format

Download: Adobe PDF, MS Word, Rich Text Format

Download: Adobe PDF, MS Word, Rich Text Format

Landlord-Tenant Laws

Statutes – Title 46, Chapter 8 (Truth-in-Renting Act), Title 2A, Chapter 42, Sections 1 – 96

Required Disclosures (4)

Flood Zone – Landlord leasing properties located in flood zones must disclose this information to tenants. Whether a piece of real estate lies in a flood plain may be determined by using FEMA’s Flood Zone Lookup Tool. This requirement does not apply to landlords property containing two (2) or fewer dwelling units, or in a property containing three (3) or fewer dwelling units when one of them is occupied by the owner, or in properties that are used as hotels, motels or for seasonal travelers. (§ 46:8-50)

Lead-Based Paint Disclosure – Landlords renting properties with dwelling units erected before 1978 are required under federal law to disclose the dangers of lead-based paints to tenants in the lease agreement.

Truth in Renting Act – This publication, explaining the rights and responsibilities of landlords and tenants, must be provided by the landlord to the tenant within thirty (30) days of the beginning of a lease, except for those properties containing two (2) or fewer dwelling units, or in a property containing three or fewer (3) dwelling units when one of them is occupied by the owner. (§ 46:8-45)

Window Guard Disclosure – The following statement must be included in every residential lease agreement in bold font (§ 5:10-27.1):

The owner (landlord) is required by law to provide, install and maintain window guards in the apartment if a child or children 10 years of age or younger is, or will be, living in the apartment or is, or will be, regularly present there for a substantial period of time if the tenant gives the owner (landlord) a written request that the window guards be installed. The owner (landlord) is also required, upon the written request of the tenant, to provide, install and maintain window guards in the hallways to which persons in the tenant’s unit have access without having to go out of the building. If the building is a condominium, cooperative or mutual housing building, the owner (landlord) of the apartment is responsible for installing and maintaining window guards in the apartment and the association is responsible for installing and maintaining window guards in hallway windows. Window guards are only required to be provided in first floor windows where the window sill is more than six feet above grade or there are other hazardous conditions that make installation of window guards necessary to protect the safety of children.

Security Deposit Laws

Maximum Amount ($)

Landlords may collect no more than one-and-a-half month’s rent as a security deposit. If the landlord is to collect an additional amount over the course of tenancy lasting more than one year, the amount may not exceed ten percent (10%) of the existing deposit per year. (§46:8-21.2)

Returning to Tenant

Landlords must return security deposits to tenants within thirty (30) days of the termination of the lease agreement, landlords must return the security deposit to the tenant. The landlord must also include in the amount returned the interest that was earned on the deposit during the duration of the tenancy. A portion or all of the deposit may be retained by the landlord for reasons specified in the lease agreement. Both the interest earned and the deductions, if any, must be shown in a written itemization included with the returned funds. (§46:8-21.1)

When is Rent Due? (grace period)

Rent is due at the time and place stated in the rental agreement. New Jersey law requires a grace period of five (5) business days, meaning that no late fees may be assessed if rent is paid within five (5) business days of the date specified in the lease agreement. (§2A:42-6.1)

Eviction Notice (non-payment)

Notice to Pay or Quit – If a tenant fails to pay rent on the date it is due, a landlord technically has the right to begin eviction proceedings immediately. (§ 2A:18-61.2) However, in practice, a landlord will likely need to provide the tenant with at least thirty (30) days’ notice, particularly if the landlord has previously accepted rent late. Generally, landlords who receive rent late are required to give tenants a written notice to cease, and to continue to remind tenants of the need to pay rent on time after every instance of accepting rent late, and to give thirty (30) days notice for eviction for habitual late payments, or paying rent late more than once. (A.P. Development Corp. v. Band)

Notice to Pay or Quit – If a tenant fails to pay rent on the date it is due, a landlord technically has the right to begin eviction proceedings immediately. (§ 2A:18-61.2) However, in practice, a landlord will likely need to provide the tenant with at least thirty (30) days’ notice, particularly if the landlord has previously accepted rent late. Generally, landlords who receive rent late are required to give tenants a written notice to cease, and to continue to remind tenants of the need to pay rent on time after every instance of accepting rent late, and to give thirty (30) days notice for eviction for habitual late payments, or paying rent late more than once. (A.P. Development Corp. v. Band)

Download: Adobe PDF

Maximum Fees ($)

Late Rent Penalties

State law does not limit how much landlords may charge tenants for failure to pay rent within the grace period, but best practice is to name the fee in the lease agreement and for the fee to be reasonable.

NSF Checks

Landlords who receive checks linked to accounts with insufficient funds to carry them may seek a late fee of $100 or three times the value of the check (up to $500), if the landlord informs the tenant, in writing, of the bounced check, and does not receive full payment within thirty-five (35) days of notifying the tenant. (§2A:32A-1)

Tenant’s Unclaimed Property

Landlords may dispose of personal property left behind by a tenant only if the landlord reasonably believes that the tenant no longer plans to claim the property, and either the tenant has given notice of leaving the property, or, in cases of eviction or abandonment, a warrant of removal has been issued delivering possession to the landlord (§2A:18-72). Landlords must store property found at their expense, but may seek reimbursement from tenants for the reasonable costs of storing property (§2A:18-77). In order to dispose of the property, the landlord must provide the tenant with written notice that the property has been found, and that the property may be disposed of within thirty (30) days (§2A:18-74). If the tenant fails to claim the property within the specified time period, the landlord may sell the property, publicly or privately, or destroy it the personal property appears to be of little value (§2A:18-78). The landlord may use the proceeds to settle any debts owed by the tenant, and any remaining amount must be held in trust for the tenant for a period of ten (10) years, after which time it shall be deposited with the local Superior Court and become property of the state. (§2A:18-80)