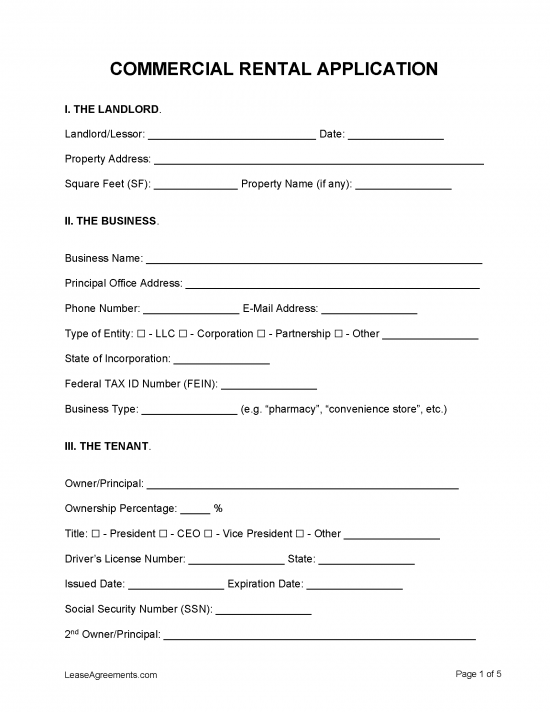

A commercial rental application is a form used to obtain personal and business information when screening a business-related tenant. The applying tenant will also have to sign the application that certifies the information they’ve entered is accurate and to consent to a credit check.

Tenant Screening (4 Parts)

- Part 1 – Rental Application

- Part 2 – Business Entity Status

- Part 3 – Tenant Screening Services

- Part 4 – Personal Guaranty Recommended

Part 1. Rental Application

It is recommended to collect the following from the prospective tenant:

- Commercial Rental Application;

- Business entity information;

- Principal’s personal information;

- Past tax returns (2 years);

- Non-refundable fee ($50-150); and

- References (past landlords).

Part 2. Business Entity Status

It’s recommended to perform a search of the Secretary of State’s office in the State where the property is located. This is to ensure the business is active and in good standing.

Part 3. Tenant Screening Services

- For Business – Use Dun & Bradstreet to check the credit of a tenant’s business. Any past due items will be shown.

- For Personal – Use the list of 11 tenant screening services.

Part 4. Personal Guaranty Recommended

Most landlords will require a personal guaranty be required to be signed by the tenant at the time of lease signing. Since a business or new business will have limited assets, it’s best for the landlord to get the tenant’s personal guarantee that the obligations of the lease will be fulfilled.